COVID-19 Small Business Resource Center

Guidance and support

We’re taking extra measures to help businesses navigate this challenging time. Below, you’ll find information on how the bank can assist you, in addition to government-funded support. We’re working diligently to track and review programs available to help you, and we'll continue to update this page with the latest information.

Loan repayment guidance tailored to your business needs

Flexibility for higher limits related to remote deposit capture

Ready to assist with SBA and FAME loan relief programs

For additional information about any of these programs and how you can get support, please reach out to your commercial banker, local banking center, or our Customer Care Team, available 24/7 at 800-860-8821.

Government-funded relief programs

COVID-19 related relief is presently available from the Federal government through the Small Business Administration (SBA). In the State of Maine, additional COVID-19 related relief is also available through the Finance Authority of Maine (FAME) and the Maine Department of Economic and Community Development (DECD).

SBA's Economic Injury Disaster Loan Program (EIDL)

Available - apply through the SBA

This program is administered through the SBA to provide small businesses (including agricultural businesses and cooperatives) and most private, non-profit organizations with working capital loans of up to $2 million to help overcome a temporary loss of revenue.

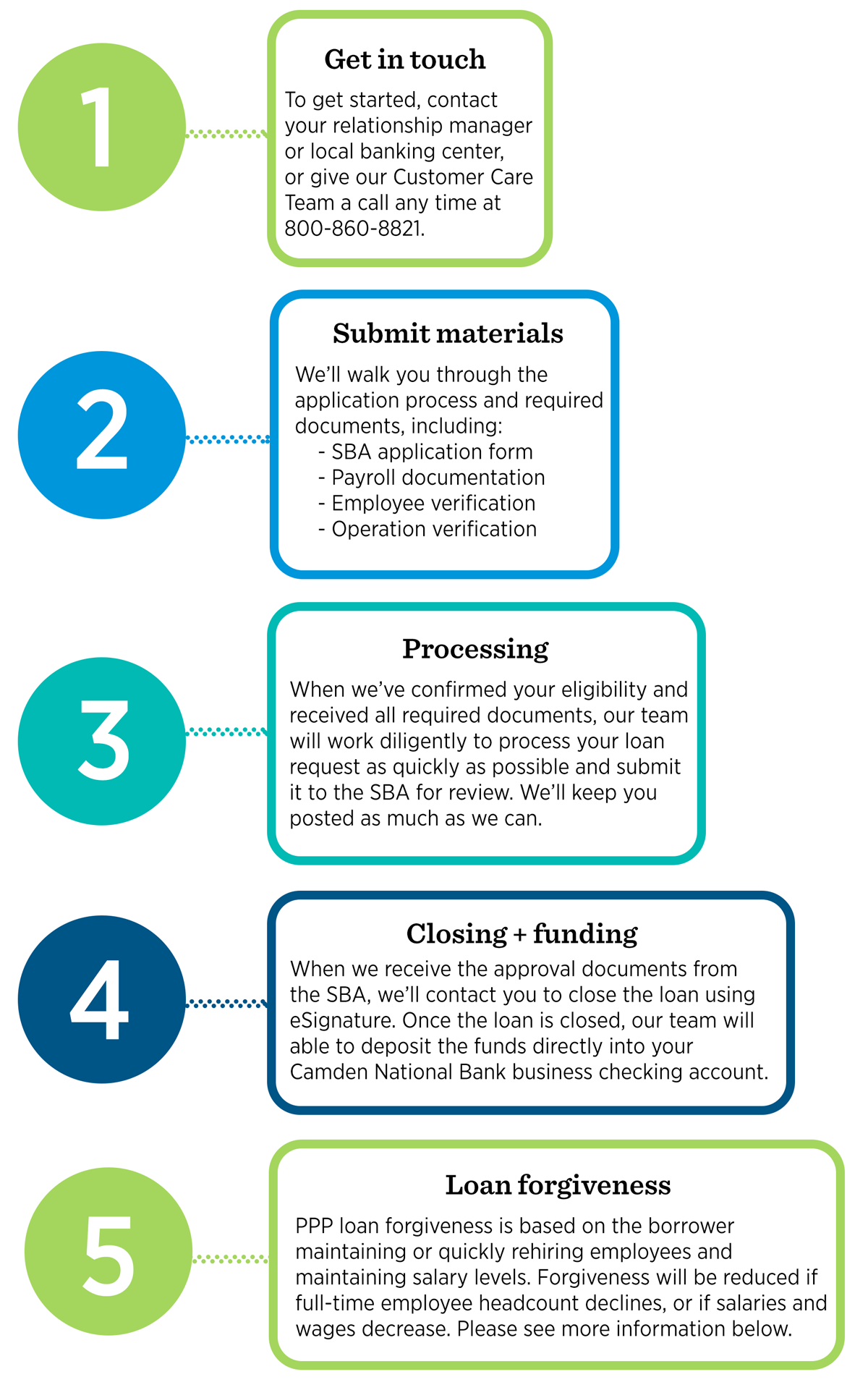

Paycheck Protection Program (PPP)

No longer accepting new applications

On December 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the “Act”) passed to provide added assistance to small businesses, primarily through additional PPP funding. Key updates to PPP were also passed, impacting eligibility requirements, the forgiveness process, and tax treatment of PPP loans.

PPP Loan Forgiveness

Up to 100% of your PPP loan is eligible for forgiveness, meaning that you don’t have to repay it, if you meet the conditions required by the SBA. The amount of forgiveness is based on the amount of loan proceeds that you use to cover eligible payroll costs, utilities, rent, and mortgage interest obligations over the 24-week period after the first loan disbursement is made (referred to as the “covered period”). PPP loans that are not forgiven may have a maturity day of up to five-years and are subject to a 1% interest rate. All loan payments are deferred for six months following the date of disbursement.

Review SBA materials and save documentation:

At this time, we encourage you to review the SBA’s website (including the loan forgiveness form and instructions, as well as FAQs) so you’re up-to-date on the latest eligibility and documentation requirements. It’s important to continue tracking your payroll costs, plus utilities, rent, and mortgage interest obligations for the covered period, as outlined by the SBA.

Our goal is to make your experience applying for PPP loan forgiveness as streamlined as possible. We’re inviting our PPP borrowers via email to apply for forgiveness electronically, and you can access our Forgiveness Resources page with helpful tips and step-by-step videos on filling out the electronic application. With the help of your business banker, this should make the process much smoother and more efficient.

Additional resources:

- Visit the U.S. Treasury website for information on application requirements

- Visit the SBA website for program FAQs

Please note: The information contained above is merely a summary and you should carefully review all rules, regulations, and written guidance from the SBA (available at www.sba.gov) with the assistance of your legal, tax, and other advisors.

Modifications to existing SBA loans

Available now - Contact us to learn more

The SBA has approved of modifications to their existing programs. If you're a current borrower and want to learn more about the options available to you, please contact the loan officer you worked with in obtaining the original loan.

SBA's Shuttered Venue Operators Grant

Learn more

The Shuttered Venue Operators (SVO) Grant program was established by The Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act, signed into law on December 27, 2020. The program includes $15 billion in grants to shuttered venues, to be administered by the Small Business Administration’s Office of Disaster Assistance. Eligible applicants may qualify for SVO Grants equal to 45% of their gross earned revenue, with the maximum amount available for a single grant award of $10 million. $2 billion is reserved for eligible applications with up to 50 full-time employees.

Maine DECD Micro-Enterprise Business Grant Program

Learn more

The Maine Department of Economic & Community Development (DECD) in partnership with the Maine Small Business Development Centers (SBDC) will provide grants of up to $5,000 for businesses with five or fewer employees, with an owner whose income is in the low to moderate range as defined by the Department of Housing and Urban Development (HUD).

FAME's COVID-19 Relief Business Direct Loan Program

Available now - Learn more

Provides FAME Direct Loans of up to $50,000 with special terms available to Maine-based businesses experiencing interruption or hardship due to COVID-19.

FAME's COVID-19 Relief Lender Insurance Program

Available now for qualified Maine borrowers - Contact us to learn more

This program provides commercial loan insurance of 50-75% to lenders who make loans to Maine businesses experiencing interruption or hardship due to COVID-19.

Information is subject to change. Loans issued by Camden National Bank may be subject to approval by the Small Business Administration, and may be required to meet program and other eligibility guidelines. Certain restrictions apply to refinancing options and are subject to program terms. Refinances of existing SBA loans are excluded. Financing maximums and terms are determined by borrower qualifications and use of funds. Camden National Bank and its representatives do not provide tax advice. Consult an advisor regarding a particular financial situation. Credit products are offered by Camden National Bank.