September 3, 2025

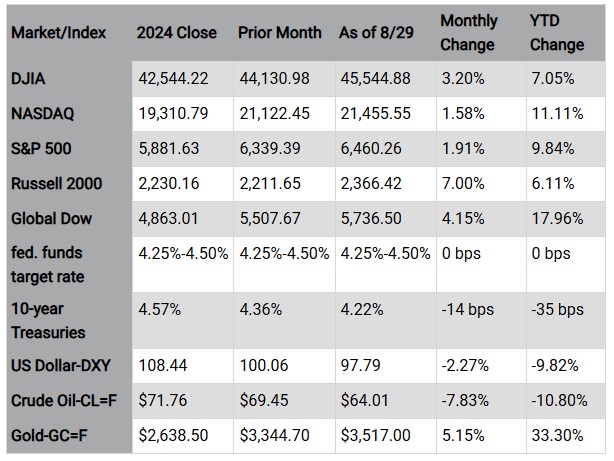

The Markets (as of market close August 29, 2025)

U.S. stocks enjoyed a notable month in August with major indexes reaching new record highs. Wall Street's performance was largely driven by strong corporate earnings (particularly in technology), an improving trade outlook, and continued economic resilience. During the month, the S&P 500 and the Dow reached record levels, while the NASDAQ saw strong gains and was just shy of its own all-time high. The information technology sector was the primary driver of the market's growth, with megacap firms, particularly AI and semiconductor companies, fueling the upturn.

Inflation continued to move away from the Federal Reserve's 2.0% target. July's Consumer Price Index (CPI), while soft on the surface, contained signs that tariffs were impacting inflation somewhat. For example, prices for furniture, photographic equipment, and vehicles rose on a monthly basis at the fastest rate since April. In addition, the 12-month personal consumption expenditures (PCE) price index excluding food and energy (core prices) has risen three consecutive months following July's increase and is now just under 3.0%. The July Producer Price Index (PPI) came in quite hot, which could be a precursor to increasing consumer prices down the line. Overall, inflationary data for July offers further evidence that customs duties are having some impact on the costs of goods and services.

The U.S. economy continued to show signs of renewed growth in the second quarter of 2025 on the heels of a modest decline in the first quarter. The gross domestic product (GDP) rose 3.3% in the second quarter following a 0.5% contraction in the first quarter. Consumer spending rose 1.6% in the second quarter after ticking up 0.5% in the first quarter. However, through the first half of the year, the GDP's annualized growth rate was projected to be 1.4%, which could be indicative of weakening private sector demand outside of the AI-driven investment boom. Some economists view tariffs, policy uncertainty, rising inflation, and tighter immigration restrictions as potentially causing increasing constraints on economic activity.

The U.S. labor market showed signs of slowing down in August, with hiring weakening, unemployment gradually increasing, and long-term concerns about job growth and labor-force participation becoming more prominent. Only 73,000 new jobs were added in July, well below expectations and notably slower than the pace of job creation seen in recent years. July's weakness was further amplified by larger-than-normal downward revisions to the May and June estimates. However, despite a slowdown in job growth, initial unemployment claims have remained relatively low, suggesting that employers may be leery of laying off workers. Nevertheless, the long-term unemployed reached 1.8 million and accounted for a quarter of all unemployed workers, which could indicate that job hunters are having a harder time re-entering the workforce.

According to FactSet, with roughly 90% of S&P 500 companies reporting, 81% of companies reported positive earnings per share (EPS). This was above the five-year (78%) and the 10-year (75%) averages. The blended year-over-year earnings growth rate for the S&P 500 in the second quarter is 11.8%, which would mark the third consecutive quarter of double-digit earnings growth for the index. The market sectors with the largest positive contributions to the overall earnings growth rate in the second quarter include communication services, information technology, and financials.

The real estate market had mixed results in July, with sales of existing homes rising, while new home sales declined. Mortgage rates eased slightly. According to Freddie Mac, the average 30-year fixed mortgage rate fell to around 6.56%, the lowest in several months. Although mortgage rates have ticked lower and inventory has increased, affordability remained the largest drawback for potential home buyers.

Industrial production edged lower in July after increasing in June. Manufacturing output was flat in July, while mining and utilities contracted. Purchasing managers reported manufacturing slowed in July, with operating conditions worsening due to a slowdown in demand as respondents indicated uncertainty in relation to tariffs. Activity in the services sector expanded in July, as increasing demand prompted companies to expand their workforces.

The bond market in August was primarily influenced by a combination of factors, including the Federal Reserve's monetary policy, economic data, geopolitical events, and ongoing tariff discourse. Ten-year Treasury yields were volatile throughout August but generally trended lower, especially after Fed Chair Powell's dovish comments suggesting an interest rate reduction in September. The two-year note, which is more sensitive to Fed policy, closed August at about 3.6%, down nearly seven basis points from the rate at the end of July. The dollar index demonstrated a period of stabilization and mixed performance in August, following a significant decline in the first half of the year. The dollar's performance was largely influenced by a combination of U.S. economic data, Federal Reserve policy, and global economic dynamics. Gold prices rose in August, marking their seventh straight monthly gain. Crude oil prices decreased for the month. Prices were largely driven by oversupply concerns, production increases, and weakening demand outlook, which were partially offset by geopolitical tensions. The retail price of regular gasoline was $3.147 per gallon on August 25, $0.024 above the price a month earlier but $0.166 lower than the price a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Looking ahead

September will be an important month for market-moving economic data. The August jobs report, released at the end of the first week of the month, follows the July report, which included significant downward revisions evidencing a potential weakening of the labor market. The Federal Reserve meets in September following a break in August. Many experts predict the Fed will cut interest rates by 25 basis points following this meeting.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"