September 4, 2024

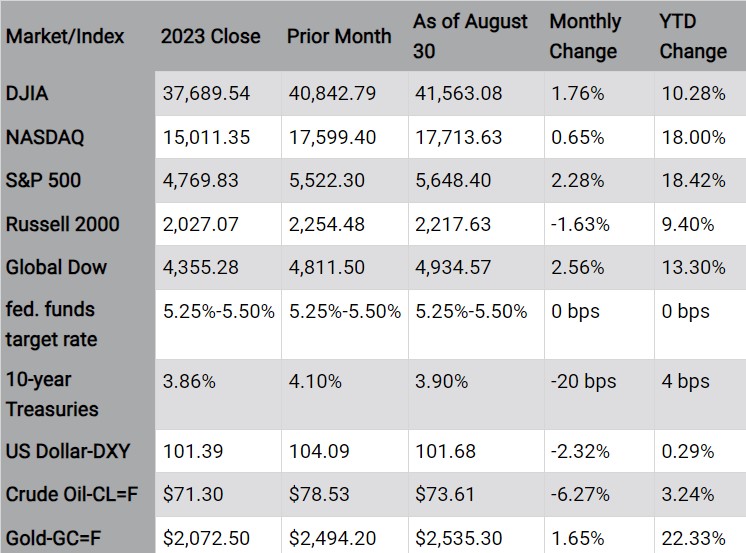

The Markets (as of market close August 30, 2024)

Inflationary data showed price pressures continued to stabilize in July, with the Consumer Price Index (CPI) and the personal consumption expenditures (PCE) index each coming in at 2.9%, year-over-year, as they inched closer to the Federal Reserve’s 2.0% target. Prices for commodities that are prevalent for most households, such as food at home, gasoline, new and used motor vehicles, and apparel, changed very little over the year. Shelter costs were up 0.4% in July and up 5.1% compared to July 2023. Shelter costs are decelerating only slowly and still a significant contributor to upward price pressure on services.

Growth of the U.S. economy continued at a modest pace, despite the Fed's restrictive monetary policy. The gross domestic product (GDP) met expectations after increasing 3.0% in the second quarter following a 1.4% increase in the first quarter. Consumer spending, the largest contributor in the calculation of GDP, rose 2.9%, with spending rising in durable goods, nondurable goods, and services. Gross domestic income, another indicator of the health of the economy, rose 1.3% in the second quarter. Moderate economic growth should be another plus as the Fed weighs its current monetary policy.

Job growth continued to slow in July, falling short of expectations. Downward revisions to estimates for June and May clearly show that average monthly gains in the second quarter of the year (177,000) are well below the average gains in the first quarter (267,000). Wage growth declined 0.3 percentage point over the past 12 months. New weekly unemployment claims decreased from a year ago, while total claims paid increased.

Nearing the end of Q2 corporate earnings season, S&P 500 companies are reporting mixed results. About 91% of the S&P 500 companies have reported results. Of those companies, 78% reported earnings per share (EPS) above estimates, which is in line with the five-year average of 77% and higher than the 10-year average of 74%. Overall, as of August 12, the index reported an aggregate earnings growth rate of 3.5%, which is below the 5-year average of 8.6% and below the 10-year average of 6.8%. In general, the market has rewarded companies that reported positive earnings surprises with price increases, while companies that fell short of earnings expectations have generally seen their stock values dip.

Sales of both existing homes and new homes rose in July. While home sales remain a bit sluggish, buyers are seeing more choices partly due to more inventory and slightly lower mortgage rates. Higher mortgage rates have slowed sales, with inventory expanding and the sales process lengthening. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.49% as of August 15, up from 6.47% one week ago, but down from 7.09% from one year ago.

Industrial production retracted in July from June, which saw a 0.3 percentage point revision lower. Manufacturing output decreased in July and was 0.1% above its year-earlier level. Within manufacturing, durables manufacturing declined 0.9% but nondurables rose 0.4%. In July, the manufacturing sector retracted in for the first time in seven months, while the services sector saw a notable expansion of business activity.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Looking ahead

The Federal Reserve meets this month. Presuming relevant data shows that inflationary pressures have moderated, it is expected that the Fed will opt to decrease the federal funds rate by at least 25 basis points.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"