January 3, 2023

In March 2022, the Federal Reserve began to aggressively raise interest rates as part of a restrictive policy aimed at reining in escalating inflation. In 2023, there were signs that the Fed's monetary policy was paying off. Price growth slowed, apparently without triggering a recession.

The personal consumption expenditures price index was 5.4% in January, while core prices, excluding food and energy, were 4.7%. Other than a moderate surge during the summer, the PCE price index trended lower, with the last reading at 2.6% (core prices were 3.2%) for the 12 months ended in November.

While inflation has turned lower, it remained above the Fed's 2.0% target. However, the progress in moderating price pressures allowed the Fed to refrain from further interest rate hikes since July. In addition, recent Fed projections indicate rate cuts of 75 basis points in 2024, possibly in the form of three 25-basis point rate reductions, although changes in the economy or inflation could prompt the Fed to alter its course of action moving forward.

Raising interest rates may have helped drive down inflation, but it also had the unfortunate effect of cooling the housing market. Rising interest rates also carried over to mortgage rates, which vaulted higher, peaking at about 8.0% in October, more than double the mortgage rate during the pandemic and well above pre-pandemic levels. Higher mortgage rates translated to fewer buyers. However, home prices climbed higher year over year, primarily due to diminishing inventory. Fortunately, mortgage rates have fallen by more than a full point over the last few months of the year, settling at about 6.61% at the end of December.

The U.S. economy proved to be resilient in 2023. Gross domestic product expanded during each of the first three quarters of the year, increasing 2.2% in the first quarter, 2.1% in the second quarter, and 4.9% in the third quarter. Consumer spending, the linchpin of the economy, also showed strength, climbing 3.1% in the third quarter. Consumers spent on both goods and services throughout the year.

The employment sector, expected by some to slow with rising interest rates, maintained strength throughout the year. While the number of new jobs trended lower during the second half of the year, job growth averaged 240,000 through November. There were 6.3 million unemployed in November 2023, compared to 6.0 million a year earlier. The unemployment rate was 3.7% and remained within a range of 3.5%-3.8% for most of the year. Average hourly earnings increased by 4.0% in 2023. The number of job openings decreased during the year but remained solid at 8.7 million.

One of the primary factors in the drop in overall inflation was a decline in energy prices. According to the Consumer Price Index, energy prices fell 5.4% over the 12 months ended in November (latest CPI data available). Gasoline prices dropped 8.9% over the same period. Food prices, on the other hand, rose 2.9%, while prices for shelter increased 6.5%.

Total industrial production declined 0.4% through November (latest data available). Manufacturing, which accounts for about 78.0% of total production, decreased 0.8%. A lengthy strike by U.S. auto workers impacted motor vehicle production in particular, and overall manufacturing in general. However, in addition to the impact of striking workers, manufacturers faced higher borrowing costs and weaker demand for goods.

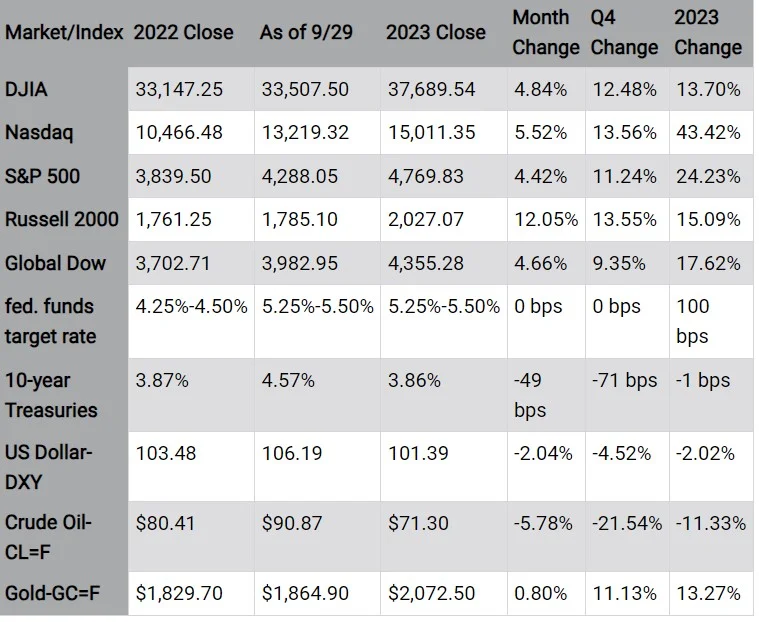

As 2023 drew to a close, there were some positives to consider upon entering the new year. The GDP expanded at a greater-than-expected pace in the third quarter, and crude oil and gas prices reversed course and dipped lower. Primary inflationary indicators, such as the Consumer Price Index and the personal consumption expenditures price index, trended lower at the end of the year. If interest rates decrease, borrowing will be available to more consumers, which should help the housing sector. Stocks enjoyed a solid bounce back in 2023. If corporate earnings continue to rebound, that would bode well for stocks in 2024. There are factors that will come into play next year, but how they impact the economy and markets is open to speculation. How much longer will the Russia/Ukraine war last, and how much more financial aid will be coming from the United States? The Hamas/Israel conflict could expand to include other countries, impacting other lives and economies. And, of course, 2024 brings with it a presidential election.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Eye on the Year Ahead

Will waning inflation and slowing job growth prompt the Federal Reserve to lower interest rates in 2024? And if interest rates are decreased, what impact will that have on the bond and stock market? Crude oil prices and retail gas prices declined in 2023. However, the ongoing conflict in the Middle East, coupled with a cut in production, could force prices for both commodities higher this year. Lastly, 2024 is an election year, which will likely fuel market volatility.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"