October 8, 2025

The Markets (third quarter through September 30, 2025)

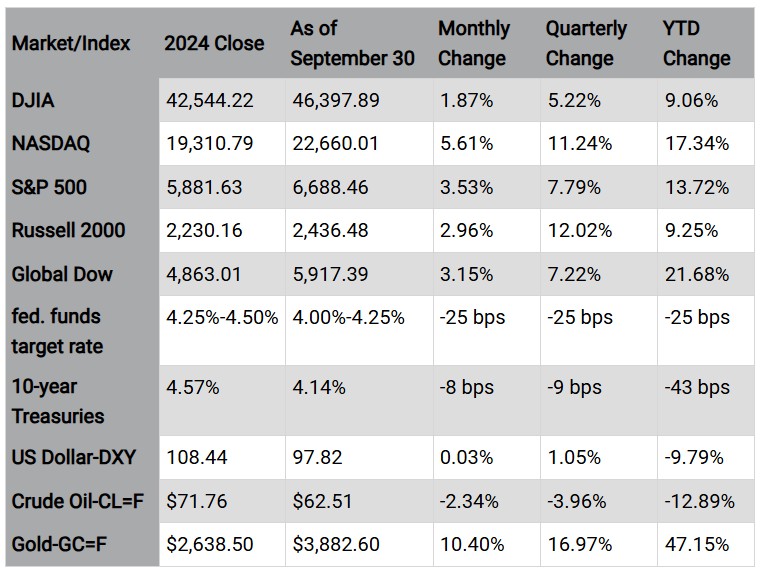

The third quarter of 2025 may best be characterized by continued strength in the equity market, moderating but resilient economic activity, and a shift in the Federal Reserve policy toward interest rate cuts. Gross domestic product rebounded notably from a lackluster opening quarter, and corporate earnings grew, while inflationary pressures showed signs of accelerating. Overall, the economy in general, and the stock market in particular, tried to gauge the impact of President Trump's tariffs, which created significant volatility early in the quarter, with major indices briefly hitting bear market territory. However, a subsequent "pause" in some tariff policies and the general resilience of the market allowed equities to rebound sharply, with investors looking past the short-term disruption.

U.S. stocks enjoyed robust growth in the third quarter, with each of the major indexes reaching multiple record highs, despite economic policy uncertainty, primarily focused on the impact of tariffs and lingering geopolitical risks. Each of the stock market indexes listed here closed higher in the third quarter compared to the previous three-month period. Even the small caps of the Russell 2000 posted significant third-quarter gains, suggesting a broadening of market strength. The ongoing rally was heavily concentrated in the information technology and communication services sectors, driven by AI and megacap tech stocks. Each of the remaining stock market sectors ended the quarter higher, with the exception of consumer staples, which closed the quarter in the red.

In what many believe was the most significant development of the quarter, the Federal Reserve cut the federal funds rate by 25 basis points in September, marking the first rate cut since the end of 2024. Despite the rate cut, inflationary pressures remained a key concern. The Fed's preferred measure of inflation, the personal consumption expenditures (PCE) price index, increased on an annual basis through August, as did the Consumer Price Index (CPI). Both measures of inflation exceeded the Fed's 2.0% target.

While inflation moved higher, the labor market slowed to a near standstill in the third quarter, which likely contributed to the Fed's decision to cut rates. Job growth slowed significantly, the unemployment rate moved higher, while the number of job openings fell to its lowest level since 2021. The number of people receiving unemployment benefits increased by nearly 100,000 over the last 12 months.

Corporate earnings reached new highs in the third quarter. The estimated 12-month earnings growth rate, according to FactSet, is projected to be about 7.9%, which would mark the ninth consecutive quarter of earnings growth for S&P 500 companies. Eight of the 11 market sectors are projected to report year-over-year earnings growth, led by information technology, utilities, materials, and financials. Energy and consumer staples are predicted to show earnings declines. The number of S&P 500 companies expected to show positive earnings per share (EPS) growth for the third quarter is higher than average.

The U.S. economy, as measured by gross domestic product, showed resilience, accelerating at an annualized rate of 3.8%, following a 0.6% contraction in the previous quarter. The U.S. real estate market continued to be impacted by relatively high interest rates, low inventory, and rising home prices. However, August (the most recent data available) showed home prices began to fall and inventory increased. Mortgage interest rates started to decline, with Fannie Mae forecasting 30-year fixed mortgage rates to end 2025 and 2026 at 6.4% and 5.9%, respectively.

Crude oil prices fluctuated somewhat throughout the third quarter, with prices moving from about $70.00 per barrel in July to $62.50 per barrel in September. The downward trend in crude oil prices was linked to concerns about softening global demand, projections of increasing supply, and geopolitical unrest, particularly regarding the Ukraine/Russia war. The retail price for regular gasoline was $3.173 per gallon on September 22, $0.026 above the price a month earlier but $0.012 below the price from a year ago.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Eye on the Quarter Ahead

October begins the last quarter of the year and brings with it plenty of important, potentially market-moving, information. The complicating factor is, that as of this writing, we are entering week two of a U.S. government shutdown. While history shows the long-term impact on markets and the economy is typically negligible, the shutdown may fuel short-term volatility. This can be exacerbated by the delay of key economic data that factors into the Federal Open Market Committee (FOMC) meetings in late October and December. The employment sector has slowed considerably over the past few months, and the economy grew at about 3.3% in the second quarter. The FOMC decided to reduce interest rates in September, and while there are a wide range of views, markets are pricing in a strong likelihood of 1 to 2 more cuts by year end.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"