October 1, 2024

The Markets (third quarter through September 30, 2024)

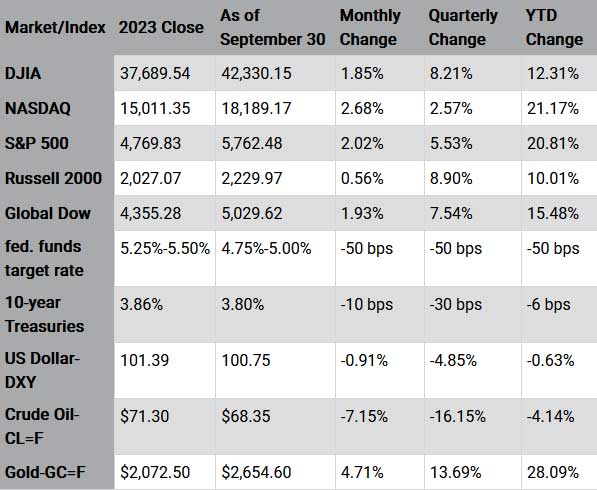

Gold rose nearly 14% in the third quarter and nearly 28% in 2024 as anticipated interest rate cuts by central banks supported trading precious metals. In addition, higher demand for gold by several Asian central banks, particularly the People's Bank of China, helped lift the price of gold, which reached a record high of $2,685.15 per ounce at the end of September. Crude oil prices fell about 16% in the third quarter as China's economic struggles, rising supplies, weak demand, and escalating tensions in the Middle East took their toll. The retail price for regular gasoline was $3.185 per gallon on September 23, $0.128 below the price a month earlier and $0.253 less than the price at the end of the second quarter. Regular retail gas prices decreased $0.652 from a year ago. The U.S. dollar ended the quarter down nearly 5%. Home mortgage rates averaged 6.2% as of September 12, about 0.57% percent lower than the July 18 rate and down from 7.18% a year ago.

July proved to be an interesting month in the stock market as tech stocks, which had been the bellwether of the market for much of the year, dipped lower, replaced by small- and mid-cap stocks. While the Federal Reserve did not change the Fed funds rate in July, there was plenty of rhetoric supporting a rate cut as early as September. Economic data and Inflation indicators offered further support to a reduction in interest rates. The CPI registered 3% for the 12 months ended in June, a 0.3 percentage point decrease from the May yearly estimate. The PCE price index increased by 2.5% for the year ended in June, down from the May figure of 2.6%. Job gains slowed to 145,000 in June (revised), below the 12-month average of 215,000. Investors seemed to make moves based on the anticipated rate cuts. Lower interest rates tend to support smaller stocks, which are generally leveraged by borrowed funds. As such, the small caps of the Russell 2000 led the benchmark indexes listed here, gaining 10.1%, which accounted for most of its year-to-date 11.2% gain. The Dow rose 4.4% and the S&P 500 inched up 1.1%. The NASDAQ dipped 0.8%. Interest-sensitive market sectors also benefited from the projected rate cuts, with real estate, utilities, and financials leading the way, while information technology and communication services closed the month lower. Anticipated rate cuts also had an impact on bonds. The inverted yield curve between the 2-year and 10-year spread flattened, with yields on 10-year Treasuries falling 24 basis points. The retail price for regular gasoline at the end of July was $3.484 per gallon, down $0.273 from July 2023.

In August, Wall Street got off to a sluggish start only to rebound by the end of the month. Each of the benchmark indexes listed here posted gains (with the exception of the Russell 2000). The Global Dow gained 2.6%, followed by the S&P 500, which rose 2.3%. The Dow advanced 1.8% and the NASDAQ ticked up 0.7%. The Russell 2000, which could not maintain its strong July performance, fell 1.6%. While tech shares rebounded somewhat, the market broadened in general. Real estate and consumer staples led the market sectors, while consumer discretionary and energy declined. The Federal Reserve did not meet in August. However, Fed Chair Jerome Powell clearly intimated that there was strong consideration to lowering interest rates in September. With inflation indicators continuing to show a disinflationary trend, the focus shifted to employment, where job gains in July slipped to 89,000 (revised), while the unemployment rate settled at 4.2%. Bond prices rose again, dragging yields down 20 basis points to 3.9%. However, despite favorable stock market returns and a stabilized inflation rate, concerns over the shrinking labor market, a slowdown in industrial production, and the switch of presidential candidates, prompted some skepticism among investors.

September, which is historically a poor month for stocks, bucked that trend, with each of the benchmark indexes listed here closing the month higher. The Fed's 50 basis-point interest rate cut, coupled with signs of resilience in the economy, helped raise investor confidence in the stock market. Each of the indexes listed here closed September higher, despite a slow start to the month. Consumer discretionary and utilities led the market sectors, which generally performed well in September, with the exception of health care, real estate, and energy, which lagged. Ten-year Treasury yields dipped lower. As aforementioned, the Fed cut interest rates by 50 basis points following the conclusion of its meeting on September 18. As a result, stocks moved generally higher, although several of the Fed officials tempered their comments concerning whether or when additional rate cuts may occur. Crude oil prices ended the month lower as weaker demand, coupled with rising surpluses, eclipsed concerns over escalating tensions in the Middle East. Gold prices advanced in September, enjoying several record highs along the way.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Looking ahead

The Federal Reserve does not meet in October, so there will be some time to determine the impact of the September 50-basis-point rate cut. Of course, all eyes will focus on the results of the presidential and congressional elections in November.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"