July 2, 2024

The Markets (second quarter through June 28, 2024)

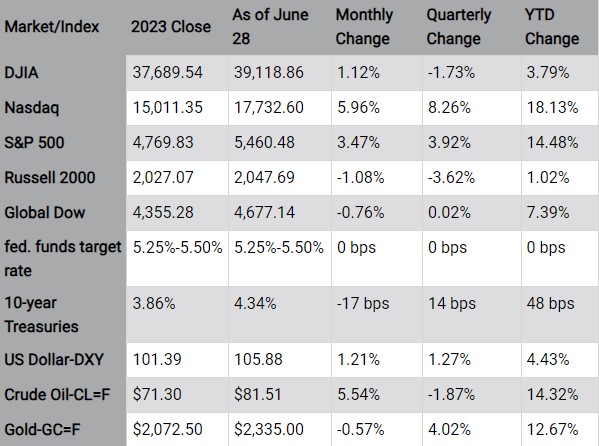

Gold rose more than 4% in the second quarter and nearly 13% in 2024 as anticipated interest rate cuts by central banks supported trading precious metals. In addition, higher demand for gold by several Asian central banks, particularly the People's Bank of China, helped lift the price of gold, which reached a record high of $2,450 per ounce in May. Crude oil prices dipped about $1.75 per barrel by the end of the first quarter. Prices on March 28 were $83.17 per barrel, dropping as low as $74.07 per barrel in early June, and settling at about $81.51 per barrel on the last business day of June. However, fears that the unrest in the Middle East will escalate, coupled with a cut in production, could drive prices higher through the remainder of the year. The retail price for regular gasoline was $3.438 per gallon on June 24, $0.139 below the price a month earlier and $0.085 less than the price March 25 estimate. Regular retail gas prices decreased $0.113 from a year ago. The U.S. dollar ended the quarter trading at its highest price since November 2023. Home mortgage rates began the quarter at about 6.82% for the 30-year fixed rate, according to Freddie Mac. Rates jumped as high as 7.03% at the end of May, ultimately settling at 6.86% on June 27.

April saw stocks get off to a slow start as progress toward reducing inflation took a step back, heightening concerns that interest rates would remain higher for longer. Each of the benchmark indexes listed here ended the month in the red, with the S&P 500 suffering its first monthly loss in the last six months. Small-cap stocks were particularly hit hard, dragging the Russell 2000 down by more than 7%, which caused that index to fall into negative territory since the beginning of the year. Ten of the 11 sectors of the S&P 500 recorded losses, with the exception of utilities, which eked out a marginal gain. The bond market also struggled in April, with the yield on 10-year Treasuries climbing 48 basis points, reaching its highest level since October. First-quarter earnings season kicked off in April and saw reports come in modestly above expectations. Investors paid particular attention to economic reports and the response from the Federal Reserve. Reports released in April revealed 315,000 new jobs added in March. The PCE price index rose 0.5% in March, while the Consumer Price Index (CPI) climbed 0.4%. Industrial production edged higher. The housing sector produced mixed results in March, with sales of existing homes falling, while new home sales advanced.

In May, equity markets rebounded from a moribund April, with each of the benchmark indexes listed here making notable gains. The Dow, the Nasdaq, and the S&P 500 reached all-time highs during the month. Tech shares outperformed, while energy declined with falling crude oil prices. Over half of the S&P 500's nearly 5.0% May gain was attributed to growth of four mega tech stocks. Investors also saw economic signs that might support an interest rate reduction. Job growth was weaker than expected. First-quarter GDP lagged to 1.3% growth. April's PCE price index (excluding food and energy prices) advanced 2.8%. April's CPI rose 0.3%, while retail sales were weaker than expected. Corporate earnings for the first quarter were favorable, as 78% of reporting S&P 500 companies beat earnings per share (EPS) estimates. Companies in the communications services sector had a growth rate of 34%, beating the other ten market sectors. Prices at the pump fell in May from April. The dollar fell nearly 1.6%, the first monthly decline in the last five months.

June proved to be a month full of ups and downs for stocks. The month began with each of the benchmark indexes listed here posting gains (with the exception of the Russell 2000). A robust jobs report helped alleviate concerns about an economic slowdown, although it bolstered the Fed's hawkish stance. Through the middle of June, tech stocks, particularly AI holdings, carried the market. Unfortunately, the rally came to a halt at the end of the month. Nevertheless, stocks closed June higher than it began, with several of the benchmark indexes closing in the black, with the exception of the Russell 2000 and the Global Dow, which closed the month lower. Most of the market sectors outperformed, with information technology and consumer discretionary leading the way. Utilities, materials, and energy were the only sectors to close in the red.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Looking ahead

Investors will likely focus much of their attention on the Federal Reserve during the third quarter of 2024. While the Fed has maintained interest rates at their current level for several months, they suggested that one decrease could be in the offing this year. Stock performance was choppy during the second quarter, with some indexes reaching record highs, only to fall back. Traders will look to the third quarter for more stability and steady gains in the market.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"