January 6, 2026

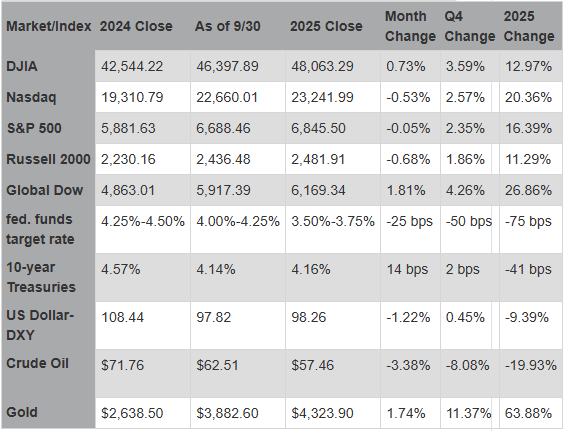

The year 2025 was extraordinary for the economy and the markets. Sweeping tariffs, a cooling labor market, rising consumer prices, a prolonged U.S. federal government shutdown, turmoil in the Middle East, and the ongoing Russia/Ukraine war were some of the many factors that should have signaled economic contraction and a downturn in the stock market. Yet, the opposite occurred. Gross domestic product expanded, largely driven by strong consumer spending. Each of the major stock market indexes listed here posted solid year-end gains. Corporate profits and earnings grew, despite the unemployment rate increasing to its highest level since September 2021. Throughout the year, there were several major events that impacted the stock market and the economy.

The year began rather benignly until April, when President Trump rolled out a fresh round of tariffs across a wide range of imported goods. Unsuspecting investors were shaken, worried about a possible recession and rising inflation. The immediate response was a major move away from equities, causing a spike in volatility. In addition to a plunge in stock prices, the value of the U.S. dollar fell, while U.S. government Treasuries, normally viewed as a safe haven, also saw a selloff, pulling bond prices lower, while pushing yields higher. Over the course of the next several months, new trade agreements prompted a reduction in some tariff rates on certain imports, helping to calm investors' concerns. Nevertheless, despite geopolitical headwinds and valuation concerns, equities delivered a robust year, largely fueled by the continued artificial intelligence boom and a resilient consumer.

The "Department of Government Efficiency" (DOGE), led by Elon Musk, implemented aggressive spending cuts and federal workforce reductions. While proponents cited long-term savings, the immediate impact included disruptions to government services and a government shutdown in October.

Consumer prices remained stubbornly elevated for much of the year. Inflation, as measured by the Consumer Price Index (CPI), stayed "sticky," hovering around 3.0%-3.1%, well above the Fed's 2.0% target. This persistence was attributed partly to new universal import tariffs and trade disputes that raised costs for goods. In 2025, prices for food rose 2.6%, while shelter prices rose 3.0%. Prices at the wholesale level rose 2.7% for the year, which included a 4.0% rise in prices for food and a 3.8% jump in energy prices.

The economy grew in 2025, despite early-year volatility and aggressive trade policy shifts. Gross domestic product expanded by approximately 1.8% to 2.0% for the full year. Growth was uneven; after a sluggish start in the first quarter, activity accelerated significantly in the third quarter, reaching a robust 4.3% annualized rate of growth before moderating again in quarter four. Consumer spending remained the primary engine of economic growth but became increasingly reliant on higher-income households. Business investment, particularly in artificial intelligence (AI) and software, provided a critical tailwind, offsetting weakness in manufacturing and housing.

According to FactSet, S&P 500 companies were projected to report earnings growth of approximately 12.1%-12.3% for 2025. This performance is well above the 10-year average of 8.6%. Corporate revenues for the year grew by approximately 6.9% to 7.0%, also surpassing the 10-year average of roughly 5.3%. The estimated net profit margin, at 12.9%-13.0%, would mark the highest annual net profit margin since FactSet began tracking the metric in 2008.

The housing sector remained relatively cool for much of the year. While mortgage rates began to recede late in the year due to Fed interest rate cuts, high prices and low inventory kept sale volumes low. Mortgage rates eased in the second half of the year after peaking at just over 7.0% in January, falling to a low of about 6.12% in October before settling at about 6.15% at the end of the year.

A distinct shift in 2025 was the softening of the labor market. The unemployment rate ticked up steadily throughout the year, starting near 4.1% and ending at approximately 4.6% in November, the highest level in four years. The rate of new hires decelerated throughout much of the year. While layoffs remained relatively low historically, the "hiring rate" plummeted. Companies became hesitant to backfill roles due to policy uncertainty and AI integration, making it harder for new entrants and the unemployed to find work. Wage gains moderated to roughly 3.5%, in line with long-term averages but lagging somewhat behind the perceived cost of living for many workers.

Overall industrial production ended the year with a gain of about 2.5%. Mining and utilities bounced up and down throughout the year, while manufacturing fought to keep from contracting, influenced by renewed trade tariffs, policy uncertainty, and the protracted government shutdown.

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments.

Eye on the Year Ahead

Looking toward to 2026, persistent inflation and a cooling labor market remain key concerns. Potential tax cuts and investment in AI could offer a balance against higher tariffs, rising prices, and a stagnant labor market.

Data sources: Economic: Based on data from U.S. Bureau of Labor Statistics (unemployment, inflation); U.S. Department of Commerce (GDP, corporate profits, retail sales, housing); S&P/Case-Shiller 20-City Composite Index (home prices); Institute for Supply Management (manufacturing/services). Performance: Based on data reported in WSJ Market Data Center (indexes); U.S. Treasury (Treasury yields); U.S. Energy Information Administration/Bloomberg.com Market Data (oil spot price, WTI, Cushing, OK); www.goldprice.org (spot gold/silver); Oanda/FX Street (currency exchange rates). News items are based on reports from multiple commonly available international news sources (i.e., wire services) and are independently verified when necessary with secondary sources such as government agencies, corporate press releases, or trade organizations. All information is based on sources deemed reliable, but no warranty or guarantee is made as to its accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation for the purchase or sale of any securities, and should not be relied on as financial advice. Forecasts are based on current conditions, subject to change, and may not come to pass. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities and other bonds fluctuates with market conditions. Bonds are subject to inflation, interest-rate, and credit risks. As interest rates rise, bond prices typically fall. A bond sold or redeemed prior to maturity may be subject to loss. Past performance is no guarantee of future results. All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.

IMPORTANT DISCLOSURES Camden National Wealth Management does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Trust and investment management services are provided by Camden National Bank, a national bank with fiduciary powers. Camden National Bank is a wholly owned subsidiary of Camden National Corporation. Camden National Bank does not provide tax, accounting or legal advice. Please consult your accountant and/or attorney for tax and legal advice.

Investment solutions such as stocks, bonds and mutual funds are:

"NOT A DEPOSIT • NOT FDIC INSURED • NOT GUARANTEED BY THE BANK • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • MAY LOSE VALUE"