No matter where you are on your financial journey—just getting started, buying a home, or planning for the future—there’s always something new to learn. Whether you’re a budgeting beginner or a seasoned saver, here are four easy ways to level up your financial smarts:

1. Make learning rewarding with Zogo Learn & Earn

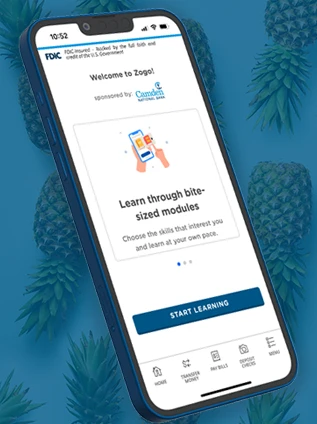

Want to sharpen your financial skills and get rewarded while you do it? Zogo Learn & Earn, available right in your digital banking app, turns bite-sized financial lessons into real-life rewards. With more than 300 short quizzes on topics like investing, saving, and home ownership, you can learn at your own pace.

The best part? You earn points (called “pineapples”) for completing these lessons, which you can redeem your gift cards from top retailers. You even receive points just for logging in. It's a fun and engaging way to grow your knowledge and earn a little something for your effort.

2. Set small, achievable savings goals

One of the simplest ways to boost your financial wellness is by building a habit of saving. Start by setting small, realistic goals: $20 a paycheck, $100 a month, or whatever works for your budget. Watching your savings grow (even little by little) can build momentum and motivation to keep going.

(If you want to start even smaller, enroll with Round Up to put spare change to work.)

3. Spot the sneaky spending to see where you’ve got wiggle room

One of the easiest ways to budget is to identify and trim unnecessary spending. Start by reviewing your recent transactions. Common culprits include overlapping grocery and takeout expenses (those poor unused leftovers in the fridge!), rarely watched streaming subscriptions, and seemingly small, frequent purchases that add up fast. By spotting these patterns, you can make smarter choices, redirect that money toward your goals, and feel more in control of your finances.

4. Talk to a local expert at your banking center

Sometimes, the best advice is just a conversation away. Whether you're curious about if that account you’ve been hearing about is right for you, are planning to buy a home, or just looking for financial tips, we’re always happy to help guide you toward smart decisions and new opportunities.