Governance

A key element of good governance

Our 10-member Board of Directors provides oversight, support, and guidance to all constituents and plays a vital role in our success.

An independent nonexecutive director, Lawrence J. Sterrs, has served as chair of the Board since 2017. Nine of our 10 directors are independent, and one is our president and CEO. The Board and its committees regularly have executive sessions attended only by independent directors.

Independent directors chair all Board committees, which include:

Customer Testimonials

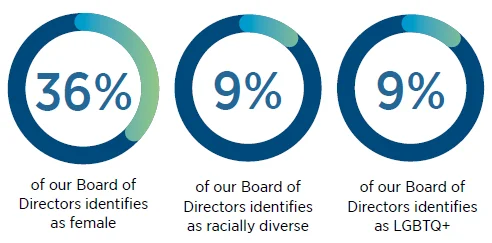

Board diversity and expertise

Our directors possess the highest personal and professional ethics, integrity, and values, and they are committed to representing the long-term interests of our shareholders.

The Board’s Diversity DEI Statement outlines the Board’s commitment to equality and inclusion across Camden National, highlighting its dedication to employing various strategies to help develop a diverse candidate pool from which director nominees are selected:

“The Corporate Governance and Risk Committee seeks nominees with a broad diversity of experience, areas of expertise, professions, and perspectives including but not limited to diversity with respect to age, race, ethnicity, gender, gender expression, and sexual orientation.”